The Importance of Giving Back During the Holiday Season

How Volunteering, Donating, Giving, and Protecting to Strengthen Our Community

The holiday season is a time filled with giving, joy, togetherness, and reflection. It’s a season where we’re reminded of what truly matters — family, health, stability, and community. But it’s also a time when many of our neighbors face their most difficult challenges: financial strain, loneliness, food insecurity, and uncertainty about the future.

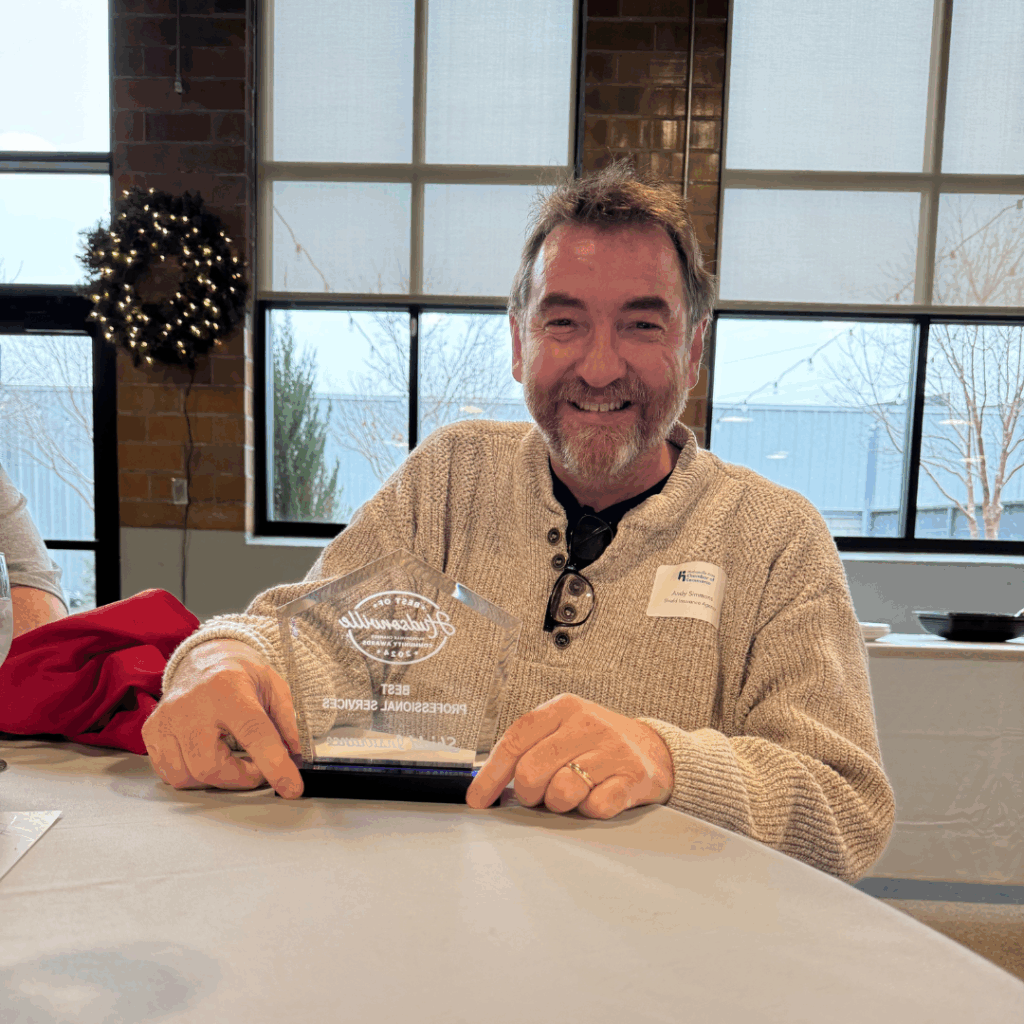

That’s why giving back through volunteering, donating, or supporting local programs is more important than ever. At Shield Insurance Agency, community isn’t just a word in our slogan — Your Protection Is Our Profession — it’s a commitment we live out.

And this week, we had the opportunity to put that commitment into action in a big way.

Stepping Up for Our Community: Meals on Wheels Volunteer Recap

This week’s volunteer team at Meals on Wheels came with a few extra challenges — and our team rose to the occasion with heart and hustle.

We were down a team member, and the plate we were assigned was more tedious and technical than usual. On the menu?

- Pot roast

- Mashed potatoes

- Gravy

- Green beans

This meal requires precision: start with a weighed portion of roast, add a generous layer of long green beans, then carefully add the mashed potatoes and gravy. It’s a lot of steps… and even more teamwork.

But our Shield crew didn’t miss a beat.

Together, we plated 540 meals for senior neighbors who depend on nutritious food delivered with care.

And when we add that to last week’s total of 1,280 meals, our team has prepared 1,820 meals in just two weeks.

That’s 1,820 moments of comfort.

1,820 reasons someone feels supported.

1,820 reminders that this community takes care of each other.

The Meals on Wheels staff was incredibly welcoming and told us they’d love to have us back anytime — and we feel the same. Thank you for the opportunity to serve, and thank you to our Shield Insurance Agency team for always showing up with heart.

We hope the photos from this week inspire others to get involved, too.

Why Giving Back Matters

The holidays amplify the struggles many people face, especially seniors who rely on programs like Meals on Wheels for food, connection, and support. When we volunteer, we help fill the gaps for those who might otherwise go unnoticed during this busy season.

And when we donate — whether it’s a toy, a meal, or warm clothing — we turn someone’s difficult holiday into a hopeful one.

This year, Shield is also hosting a Toys for Tots donation box so kids in our community can wake up to a magical Christmas morning.

Small actions create big impact.

And when a community works together, the ripple effect reaches everyone.

How Giving Back Connects to Protecting Your Family

Caring for your community and caring for your own family go hand-in-hand with the same core value: protection.

Just as volunteering and donating support neighbors in times of need, the right health and life insurance ensures your loved ones are protected when life becomes uncertain.

- Health insurance keeps families healthy, prepared, and financially protected from unexpected medical costs — especially important during the cold and flu season.

- Life insurance provides security and peace of mind, ensuring your family is taken care of no matter what the future holds.

Giving back strengthens your community.

Insurance strengthens your home.

Both reflect love, responsibility, and support — especially during the holidays.

Let’s Make This Season Brighter — Together

Whether you’re volunteering, donating, or reviewing your health and life insurance to make sure your family is protected, every action helps create a safer, warmer, more connected community.

From all of us at Shield Insurance Agency, thank you for helping spread kindness, compassion, and security this holiday season. We are honored to serve this community — both inside and outside the office.

Shield Agency Volunteers at Kids Food Basket 🔽🔽🔽🔽🔽 https://www.shieldagency.com/blog/shield-agency-volunteers-at-kids-food-basket/

Pronto Pups

Pronto Pups Big Red’s BBQ

Big Red’s BBQ Travelin’ Tom’s Coffee

Travelin’ Tom’s Coffee The Countdown We All Wait For

The Countdown We All Wait For Proud to Be Part of Hudsonville

Proud to Be Part of Hudsonville 3214 Chicago Dr, Hudsonville, MI 49426

3214 Chicago Dr, Hudsonville, MI 49426 616-896-4600

616-896-4600

Voting is open October 20 – November 21

Voting is open October 20 – November 21

Your Protection Is Our Profession: Our Team, Our Clients, Our Commitment

Your Protection Is Our Profession: Our Team, Our Clients, Our Commitment To provide exceptional service.

To provide exceptional service.

The Brewster – Beer cheese, bacon, and onion rings on a pretzel bun (an instant classic!)

The Brewster – Beer cheese, bacon, and onion rings on a pretzel bun (an instant classic!) BBQ Bacon Cheddar – Smoky, cheesy, and perfectly messy — the ultimate comfort burger.

BBQ Bacon Cheddar – Smoky, cheesy, and perfectly messy — the ultimate comfort burger. Spicy Peanut Butter Burger – Jalapeño, bacon, cheddar, and peanut butter — the unexpected combo that worked!

Spicy Peanut Butter Burger – Jalapeño, bacon, cheddar, and peanut butter — the unexpected combo that worked!

Costumes & Decorations

Costumes & Decorations

Watch the Treats: Candy — especially chocolate or sugar-free sweets with xylitol — can be dangerous for pets. Keep it out of reach!

Watch the Treats: Candy — especially chocolate or sugar-free sweets with xylitol — can be dangerous for pets. Keep it out of reach! Costume Comfort: If your pet loves dressing up, make sure their costume fits well and doesn’t restrict breathing or movement.

Costume Comfort: If your pet loves dressing up, make sure their costume fits well and doesn’t restrict breathing or movement. Pet-Safe Décor: Keep candles, cords, and small decorations out of reach from curious paws and tails.

Pet-Safe Décor: Keep candles, cords, and small decorations out of reach from curious paws and tails. Secure Spaces: With trick-or-treaters at the door, it’s easy for pets to slip outside unnoticed. A quiet, cozy room can help keep them calm.

Secure Spaces: With trick-or-treaters at the door, it’s easy for pets to slip outside unnoticed. A quiet, cozy room can help keep them calm.

Celebrate Safely and Confidently

Celebrate Safely and Confidently